Introduction: Your Financial Crash Course Starts Now

College is a thrilling independence, but that freedom often comes with a harsh reality check at the end of the month. The good news? You don’t have to choose between enjoying your college experience and being financially smart. With a few simple habits, you can take control of your cash, avoid the dreaded “ramen noodle” phase, and even start building a solid financial foundation. Think of this as your essential, non-credit financial literacy course.

Your 10-Step Playbook to Financial Swagger in College

1. Know Where Your Money is Actually Going

You can’t manage what you don’t measure. For one week, track every single rupee—from that 50₹ chai to your online subscription. Use a simple notes app, a Google Sheet, or a budgeting app. You’ll be shocked at how those “small” purchases add up. This is the most important first step.

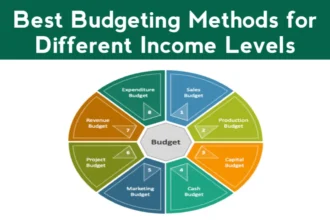

2. Build a Budget That Breathes

A budget isn’t a prison; it’s a plan for your freedom. Don’t make it overly complex. Use a simple method like the 50/30/20 rule, adjusted for students:

- 50% on Needs: Hostel fees, groceries, essential transport, books.

- 30% on Wants: Eating out, movies, shopping, hobbies.

- 20% on Future You: Savings and any debt repayment.

This framework gives you structure without suffocation.

3. Become a Kitchen Wizard

Eating out is a major budget drain. You don’t need to be a chef—master 3-4 simple, healthy meals you can cook in bulk (think pasta, stir-fries, dal-rice). Cooking with friends can make it fun and even cheaper. The money you save is literally like giving yourself a raise.

4. Unleash the Power of Your Student ID

Your student ID is a discount goldmine. Always ask, both online and in-store! Flash it for discounts on:

- Tech: Software, laptops, streaming services.

- Shopping: Clothing brands, movie tickets, museums.

- Food: Many cafes and restaurants offer student deals.

A 10-20% discount on everything adds up to thousands saved per year.

5. Declare War on Impulse Buys

Before any non-essential purchase, impose a 24-hour “cooling-off” rule. See something you “need” online? Add it to your cart and walk away for a day. Often, the urge to buy will pass, saving you from clutter and regret.

6. Ditch Expensive Rides

If it’s within a 20-minute walk or cycle, don’t take a rickshaw or cab. Not only will you save a significant amount each month, but you’ll also get free exercise. For longer distances, student bus passes or metro cards are your best friends.

7. Make Saving Automatic and Painless

Pay Yourself First! Set up an automatic transfer of a small, fixed amount (even 100₹/week) from your main account to a separate savings account the day you get your allowance. Out of sight, out of mind. Watch this “emergency fund” or “goal fund” grow without any effort.

8. Find Your Fun for Free

Your campus and city are filled with free entertainment: club events, guest lectures, open-mic nights, park hangouts, and college festivals. Actively seek these out instead of defaulting to the mall or an expensive cafe.

9. Get Tech-Savvy with Cashback

Use cashback and reward apps strategically for purchases you were already going to make. Whether it’s your bank’s credit card rewards or apps like CashKaro, a little effort can net you decent money back on groceries, fuel, and online shopping.

10. Tap into Campus Wisdom

Your seniors and financially-savvy friends are a treasure trove of insider info. They know where to find:

- Second-hand textbooks (save a fortune!).

- The best and cheapest food joints.

- Free resources and campus hacks.

Don’t be shy—ask them how they manage their money.

Real Talk: A Student’s Turnaround

Rohan’s Story: Rohan was constantly running out of money by the 20th of the month. He started tracking his spending and discovered he was spending over 2,500₹ just on late-night food delivery and bubble tea.

His Action Plan:

- He committed to meal-prepping his dinners 4 days a week.

- He deleted the food delivery apps from his phone.

- He used the money saved to join a free campus cycling group.

The Result: In one month, he not only saved 1,800₹ but also felt healthier and made new friends. He re-allocated that saved cash to a fund for a post-exams trip.

The Bottom Line

Managing money in college isn’t about deprivation; it’s about making smart choices that let you enjoy today while securing tomorrow. The financial habits you build now—tracking, saving, and spending consciously—will pay dividends long after you graduate.

Your first assignment? Pick one tip from this list and implement it this week.

Got a killer money-saving hack of your own? Share it in the comments and help your fellow students out! And if this guide helped, pass it on—someone in your class is probably stressing about money right now.